Income Tax Fundamentals 2018 Pdf Free Download

Paying your income tax for the first time is a milestone in any citizen'southward life. Nonetheless, the process can seem besides daunting and tedious for a offset-timer, and some of the terms tend to go right over your caput. This needn't be and then. To help you understand the tax implications of your income (based on your income source), here is a compilation of basics of income tax for beginners.

Basics of Income Tax for Beginners

Are you merely out of college and looking for a job? Or have you already landed the job and are going to file your income tax returns for the first fourth dimension? If nitty-gritty of income tax and investments confuse yous, ClearTax is here to aid. Our aim at ClearTax is to simplify Income Taxes for y'all and make your financial lives easier. Basically, everyone with an income is liable to file income tax returns. Today we bring to you the basics of Income Tax yous'll need to equip yourself with and this should aid you take a confident offset stride into your job.

Defining the 'Previous year'

Previous twelvemonth or the financial year or your tax year is the 12 month flow that begins on 1st April and ends on the 31st March of the adjacent year. No matter when you offset your job, your tax year closes on 31st March and a new tax year starts on 1st April. Then, it is of import to programme your taxes for each financial year.

Assessment Twelvemonth

It is a term you'll frequently hear in relation to revenue enhancement filing. It is the financial year afterwards the previous twelvemonth in which y'all volition 'assess' and file your return for the previous year. Then, assessment year is 2019-twenty for the previous year 2018-nineteen. Assessment year is the yr in which you lot volition file your return for the previous year. For case, if you start your chore on 1 January 2021, your taxation year closes on 31 March 2021. 2020-21 is your previous year and your AY is 2021-22. The terminal day to file your return is 31st July 2021 (extended to 31st December 2021).

Understanding your Salary

When you start your job – reach out to your payroll or Hour department and get your Bacon details/ Pay Slip / Tax Statement. Here, you will go an idea of the major components of your bacon and how much taxation will be deducted from your salary based on them.

Case: Nearly companies requite House Rent Allowance or HRA, and you tin can salve taxation on that if you are living on rent.

Income on which you pay Tax

Also the bacon income you receive, you may be earning an income from several other sources. Your Total Income is the sum total of all heads of income beneath.

Sources of Income

| Income from Salary | Salary, Allowances, Leave encashment basically all the money yous receive while rendering your chore as a result of your employment agreement |

| Income from Business firm Property | Income from house or building, this may be owned and self-occupied or may be rented |

| Income from Upper-case letter Gain | Income from gain or loss when you sell a capital asset |

| Income from Business organization or Profession | Income/loss that arises as a effect of carrying on a business concern or profession |

| Income from Other Sources | This is the residual head – includes your income from savings bank accounts,fixed deposits,family alimony or gifts received |

Deductions

Deductions reduce your Gross Income. These are the amounts Income Tax Department allows yous to reduce your Income, bringing down your tax liability.

Sum of All heads of Income = Gross IncomeGross Income – Deductions = Taxable Income

The more you brand use of the deductions allowed, the lower your taxation shall be. Deductions are allowed under section 80 of the Income Taxation Act (Department 80C to 80U).

Brand Section 80C your best friend

Section 80C can take off INR 1,fifty,000 from your Gross Income. Given below are some of the widely-used investment vehicles under this section.

PPF

Ane of the near popular deductions under 80C is deposits to Public Provident Fund or PPF. When you open a PPF account, y'all need to deposit a minimum of INR 500 and a maximum of INR i,50,000 in a twelvemonth. Money deposited in a PPF account compounds, as you deposit more than money in the subsequent financial years to claim deductions. PPF is a traditional and safe saving artery to park your hard earned money. A PPF business relationship can be easily opened with a banking company.

Tax-saving FD

Fixed deposits assure capital protection every bit well as a sizable interest income for investors. To go tax benefits under 80C, you demand to stay invested for at least five years. It is safety, but the Interest Income from it is taxable.

Tax-saving mutual funds or ELSS

1 of the only common fund scheme allowed under 80C, ELSS (Equity Linked Savings Scheme) is gaining popularity among people for its historically higher performance in the contempo years. Another perk of ELSS is that it has the everyman lock-in period of 3 years.

TDS or Taxation deducted at source

TDS is Tax Deducted at Source – it means that the tax is deducted by the person making payment. The payer has to deduct an amount of tax based on the rules prescribed by the income tax department. For example, An employer will gauge the full almanac income of an employee and deduct tax on his Income if his Taxable Income exceeds INR 2,50,000. Tax is deducted based on which tax slab you lot belong to each year. Similarly, if you earn interest from a Fixed Deposit, the bank besides deducts TDS. Since the bank does non know your taxation slabs, they normally deduct TDS @ 10%, unless you haven't mentioned your PAN (in that case a 20% TDS may exist deducted).

Calculating Revenue enhancement Payable

On your Taxable Income, taxation slabs or rates are applied and final tax payable is calculated. From this revenue enhancement payable, you can reduce all the TDS that has already been deducted.

You lot can e'er use our Taxation Calculator!

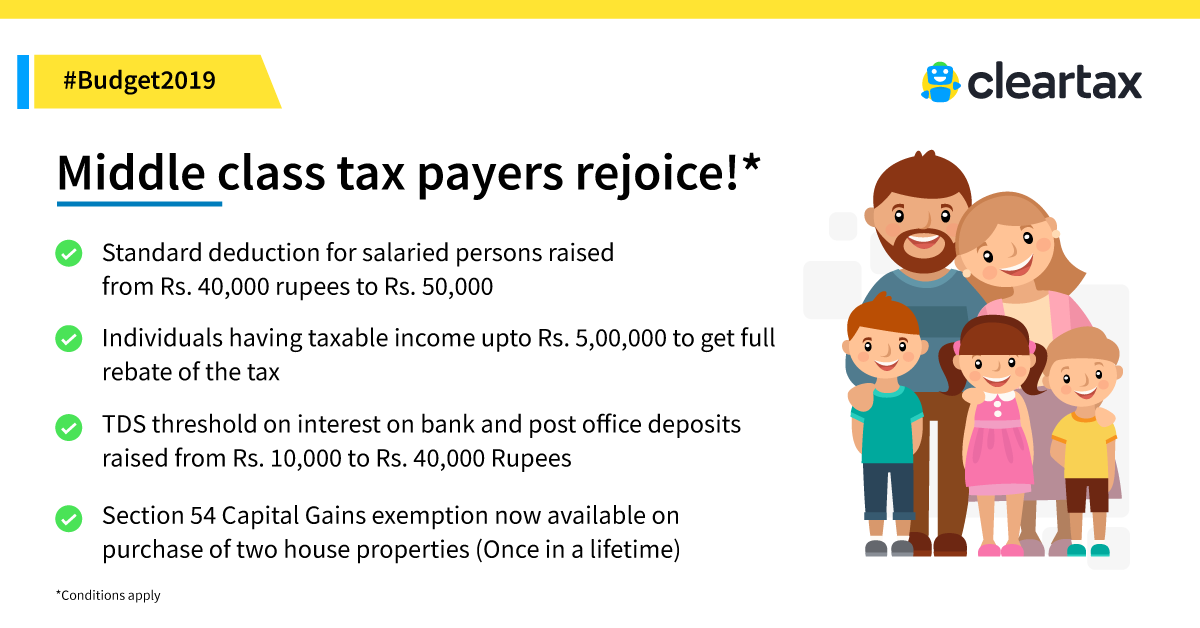

Standard Deduction

Equally per the Budget 2018, salaried employees are entitled to a standard deduction of Rs 40,000 from the gross salary. This standard deduction will replace the medical reimbursement amounting to INR xv,000 and transport allowance amounting to Rs. 19,200 in a financial year. Effectively, the taxpayer will get an additional income exemption of Rs v,800. The limit of Rs. 40,000 has been increased to Rs. 50,000 from FY 2019-20 onwards in the Interim Budget 2019.

Illustration on salary TDS

Aditya is a 25-year-old software engineer living in Bombay. He spends his free time enjoying his new found financial freedom. This is his first job and he's clueless virtually tax or savings. But it'due south almost the terminate of January and Aditya heard his friends talking about Department 80C and how they pay zip tax thanks to Section 80C. Aditya earns Rs half dozen,lx,000 annually. Here are his salary details.

| Salary components | Monthly | Annually |

| Bones bacon | thirty,000 | 3,60,000 |

| House Rent Allowance | 15,000 | i,80,000 |

| Special Allowance | x,000 | 1,twenty,000 |

| Total | vi,60,000 |

Aditya looked up his pay slip and institute out that his employer has been deducting a TDS on his salary of Rs ii,988 each month. This shall piece of work out to Rs 35,860 for the whole twelvemonth. While Aditya has been busy enjoying his new life he has no inkling how much tax he needs to pay and whether he can save any tax! Let'southward help him!

Aditya should outset observe out his full income from all sources. Besides salary income, Aditya has earned savings bank business relationship interest of Rs two,500. He found this amount in his banking concern statement. His male parent had forced him to put aside Rs fifty,000 in fixed deposit and from his online FD statement, he plant out he will earn an interest of Rs 3,500 on this FD until 31st March 2020. Aditya is non certain whether any TDS has been deducted on his interest income – so he looks upward his Grade 26AS. Form 26AS has the details of all the taxation deducted and deposited against Aditya'due south PAN. He found TDS of Rs 2,988 deducted past his employer each month until January.

Here is Aditya's total Income:

| Income from salary | Rs 6,sixty,000 | |

| Income from other sources | Rs six,000 | |

| Savings Bank business relationship interest | Rs 2,500 | |

| Fixed Eolith interest | Rs iii,500 | |

| Gross Total Income | Rs half-dozen,66,000 | |

| Tax deducted or TDS till the finish of January 2020 (Rs two,988*x) | Rs 29,880 |

Aditya as well revealed he lives in a rented accommodation in Mumbai along with 4 other roommates and his share of hire is Rs ten,000. If Aditya can organize hire receipts from the landlord and become his PAN number, he can claim an exemption on HRA. If Aditya tin submit the rent receipts well in time, to his employer – his employer will exist able to accommodate his tax calculations.

Aditya's HRA exemption

| HRA exemption shall exist least of the post-obit: | |

| HRA received (A) | Rs 15,000 |

| 50% of the basic salary | Rs 15,000 |

| Hire paid less x% of the bones bacon | Rs vii,000 |

| HRA exempt (lower of the above) (B) | Rs seven,000 |

| HRA taxable (A)-(B) | Rs eight,000 |

Now allow us see Aditya's revised taxation calculation.

| Aditya'due south revised taxation calculation | ||

|---|---|---|

| Income from salary | Rs 5,76,000 | |

| Bones bacon | Rs 3,60,000 | |

| Taxable portion of HRA | Rs 96,000 | |

| Special assart | Rs 1,20,000 | |

| Income from other sources | Rs half-dozen,000 | |

| Gross total income | Rs 5,82,000 | |

| Deduction under section 80C | Rs 1,fifty,000 | |

| Deduction nether department 80TTA | Rs ii,500 | |

| Total income | Rs 4,29,500 | |

| Tax payable | Rs eight,975 | |

| Less: Rebate under section 87A (for total income up to Rs 5 lakh) | Rs viii,975 | |

| Tax payable | Nil | |

Did you discover? If Aditya can manage to claim Rs 1,50,000 under section 80C – no tax shall be payable past him on account of rebate claimed under section 87A. With this deduction, his taxable income does not exceed Rs 5 lakh which is eligible for rebate under department 87A for the AY 2020-21.

Nevertheless, Aditya has to file an income tax return considering his gross total income is in a higher place the basic exemption limit of Rs 2.v lakh. Too, Aditya can claim a refund of the TDS of Rs 29,880 which has been deducted on his income. Aditya claims Rs 1,l,000 under section 80C. Deduction on Department 80C is available for PF @12% of Basic Bacon, its Rs 43,200 for him. Since this is already deducted from salary, he simply needs to consider this amount – no additional payout is required.

Aditya wants to try his hands in equities and finds the market returns promising and so he invests Rs 50,000 in ELSS. He opens a PPF account and deposits Rs 57,580 – all of these add upward to Rs 1,l,780. The amount of deduction eligible nether department 80C is express to Rs one,50,000. Accordingly, Aditya claims a deduction of Rs 1,50,000 under section 80C.

Deduction under department 80C bachelor to Aditya

| EPF contribution @ 12% of basic salary | Rs 43,200 |

| Subscription to ELSS | Rs fifty,000 |

| Contribution to PPF | Rs 57,580 |

| Total | Rs one,50,780 |

| Eligible deduction | Rs 1,l,000 |

File your income tax for Free in 7 minutes

Complimentary, simple and authentic. Designed by tax experts

DOWNLOAD HERE

Posted by: stewartaftecte84.blogspot.com

Post a Comment